Iso 20022 Xml Format Bank Of America

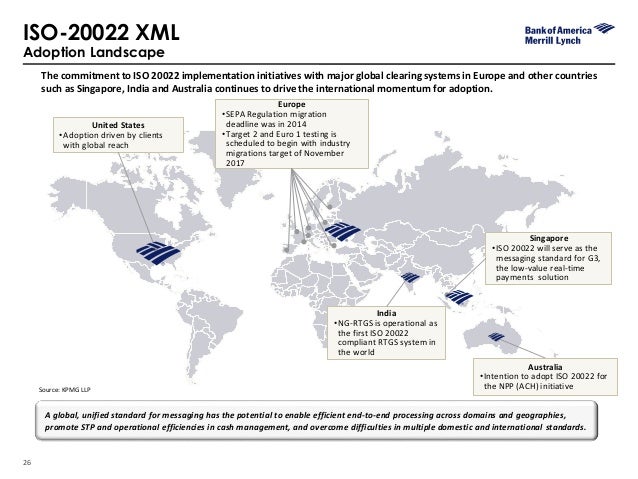

For the multi-banked corporate, ISO 20022 XML messaging provides the opportunity to establish a low-cost, low-maintenance cash management architecture that enables both financial and operational efficiencies. This article considers the challenges that currently exist in the bank statement reconciliation space and the experience of. Sep 19, 2011. For years, banks and corporate treasuries have struggled to implement standard payments and cash reporting formats. The ISO 20022 Common Global Implementation (CGI) is a collaborative effort driven by Microsoft, two of its major global banking partners, Bank of America Merrill Lynch and Citi, and.

This topic explains how to set up positive pay and generate positive pay files.

Set up positive pay to generate an electronic list of checks that is provided to the bank. Then, when a check is presented to the bank, the bank compares it with the list of checks. If the check matches a check in the list, the bank clears it. If the check doesn't match a check in the list, the bank holds it for review.

Security for positive pay files

Positive pay files can contain sensitive information about payees and check amounts. Therefore, make sure that you use appropriate security measures from the time that the files are generated until they are received by the bank. Positive pay files are downloaded to the location that is specified by your web browser. Because positive pay files can contain sensitive information, it's important that only authorized users have access to generate and view this information in Microsoft Dynamics 365 for Finance and Operations. Use the following table to help you determine the privileges that are required.

| Task | Privilege |

|---|---|

| Generate positive pay files from the Bank accounts list page or the Bank accounts page. |

|

| Generate positive pay files for multiple legal entities and bank accounts from the Generate a positive pay file page. |

|

| View positive pay files on the Positive pay file summary page. | View bank positive pay information for multiple legal entities (BankPositivePayView) |

| Confirm a bank positive pay file on the Positive pay file summary page. | Confirm positive payment file (BankPositivePayConfirm) |

| Recall a bank positive pay file on the Positive pay file summary page. | Recall positive pay file (BankPositivePayRecall) |

Set up a positive pay format

Positive pay files are created by using data entities. Before you can generate a positive pay file, you must set up a transformation input format that will be used to translate the check information into a format that can communicate with the bank. On the Positive pay format page, you can create a file format identifier and a description. The transformation input format must be of the XML type. The specific format depends on the transformation file that you're using. For example, the sample Extensible Stylesheet Language Transformations (XSLT) file that is provided uses the XML-Element format. Use the Upload file used for transformation action to specify the location of the transform file for the format that your bank requires.

Example: XSLT file for positive pay file

Assign the positive pay format to a bank account

For each bank account that you want to generate positive pay information for, you must assign the positive pay format that you specified in the previous section. On the Bank accounts page, select the positive pay format that corresponds to the bank account. In the Positive pay start date field, enter the first date to generate positive pay files. It's important that you enter a date in this field. Otherwise, the first positive pay file that you generate will include all checks that have ever been created for this bank account.

Assign a number sequence for positive pay files

Each positive pay file must have a unique number. Use the Number sequences tab on the Cash and bank management parameters page to create a number sequence for positive pay files.

Generate a positive pay file for a single bank account

You can generate a positive pay file for a single legal entity and a single bank account. For information about how to generate positive pay files for multiple legal entities and bank accounts at the same time, see the next section. To generate a positive pay file for a single legal entity and a single bank account, open the Generate a positive pay file dialog box from the Bank accounts page. In the Cut-off date field, enter the last check date to include in the positive pay file. All checks that haven’t been included in a positive pay file by the end of this check date are included in the file.

Generate a positive pay file for multiple bank accounts

To generate a positive pay file for multiple bank accounts, use the Generate a positive pay file periodic task. Select the positive pay format for the file, and specify whether to generate the file for all legal entities or for a selected legal entity. You can also generate the positive pay file for all bank accounts that use the specified positive pay format or for a selected bank account. In the Cut-off date field, enter the last check date to include in the positive pay file. All checks that haven’t been included in a positive pay file by the end of this check date are included in the file.

View the results of positive pay file generation

Xml Formatter

After the positive pay file is generated, you can view the results on the Positive pay file summary page. To view the details of the individual checks, use the Positive pay file details page.

Confirm a positive pay file

After the checks that are listed in a positive pay file have been paid, you receive a confirmation number from your bank. You can then confirm the positive pay file. On the Positive pay file summary page, select a positive pay file that has a status of Created, and then select the Enter confirmation action. When you confirm a positive pay file, the confirmation number that you received from the bank is recorded.

Recall a positive pay file

If you must change a positive pay file, you can recall it. On the Positive pay file summary page, select a positive pay file that has a status of Created, and then select the Recall action. For each check in the positive pay file, the field that indicates whether that check has been included in a positive pay file is reset. You can then create a new positive pay file that includes the check that was recalled.

ISO 20022 is an ISOstandard for electronic data interchange between financial institutions. It describes a metadata repository containing descriptions of messages and business processes, and a maintenance process for the repository content. The standard covers financial information transferred between financial institutions that includes payment transactions, securities trading and settlement information, credit and debit card transactions and other financial information.

The repository contains a huge amount of financial services metadata that has been shared and standardized across the industry. The metadata is stored in UML models with a special ISO 20022 UML Profile. Underlying all of this is the ISO 20022 metamodel - a model of the models. The UML profile is the metamodel transformed into UML. The metadata is transformed into the syntax of messages used in financial networks. The first syntax supported for messages was XML Schema.

ISO 20022 is widely used in financial services. Organizations participating in ISO 20022 include: FIX Protocol Limited (Financial Information eXchange), ISDA (FpML), ISITC, Omgeo, SWIFT, and Visa.

ISO 20022 is the successor to ISO 15022; originally ISO 20022 was called ISO 15022 2nd Edition. ISO 15022 was the successor of ISO 7775.

Parts of the standard[edit]

- ISO 20022 Financial services – Universal financial industry message scheme

- ISO 20022-1:2013 Part 1: Metamodel

- ISO 20022-2:2013 Part 2: UML profile

- ISO 20022-3:2013 Part 3: Modelling

- ISO 20022-4:2013 Part 4: XML Schema generation

- ISO 20022-5:2013 Part 5: Reverse engineering

- ISO 20022-6:2013 Part 6: Message transport characteristics

- ISO 20022-7:2013 Part 7: Registration

- ISO 20022-8:2013 Part 8: ASN.1 generation

Management of the standard[edit]

- The Standard is issued by ISO Technical Committee 68 (TC68), which is responsible for Financial Services in ISO.

- The Standard is managed by Working Group 4 (WG4), a sub-group of TC68 whose charter is 'the management of ISO 20022'.

- The Standard defines a Repository Management Group (RMG) Composed of senior industry experts. It is the highest registration body.

- SEG Standard Evolution Group composed of industry experts in specific business domains of the financial industry

- SWIFT is the Registration Authority for ISO 20022. RA is the guardian of the ISO 20022 financial repository.

Adoption[edit]

A 2015 report by the United States's Federal Reserve System classified Europe having 'mature adopters' of ISO 20022; India, South Africa, Japan, Singapore, and Switzerland as having 'growing adopters'; and Australia, Canada, the United Kingdom, and New Zealand as having 'interested adopters'. The report concluded that the Federal Reserve should push for ISO 20022 adoption within the United States financial system.[1]

Australia's New Payments Platform, launched in February 2018[2], uses ISO 20022 messaging[3].

In July 2018, the Federal Reserve Board of Governors requested comments on the proposed adoption of the ISO 20022 message format in a migration beginning in 2020 and ending in 2023.[4]

Iso 20022 Xml Format Bank Of America Download

Implementation[edit]

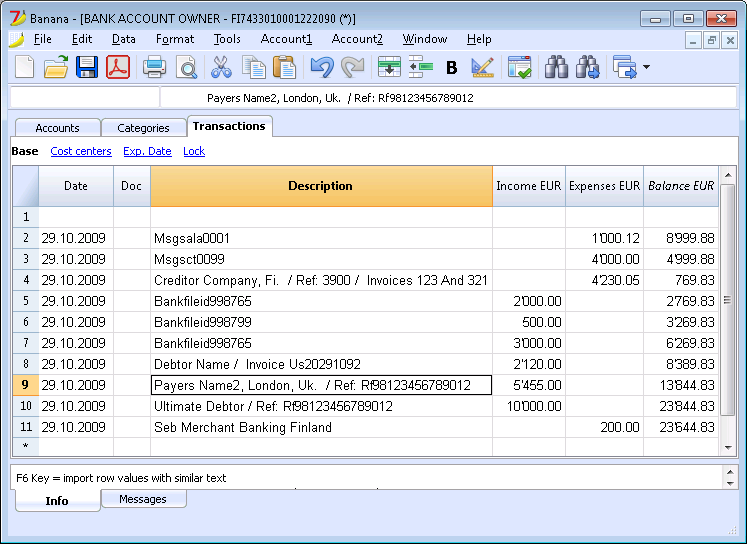

Cash management for companies and institutions:

- CAMT.052: Bank to customer account report. Follow-up of online transactions.

- CAMT.053: Bank to customer account statement. Detailed and structured payment data.

- CAMT.054: Bank to customer debit/credit notification

See also[edit]

References[edit]

- ^'Strategies for improving the U.S. payment system'(PDF). Federal Reserve System. 26 January 2015. Retrieved 2015-05-16.

- ^'The New Payments Platform Launches'(PDF). NPPA. 13 February 2018. Retrieved 2019-03-19.

- ^'The Platform'. NPPA. Retrieved 2019-03-19.

- ^'New Message Format for the Fedwire® Funds Service'. Federal Register. 2018-07-05. Retrieved 2019-02-18.

External links[edit]

- iso20022.org ISO/TC68/20022/RMG - Registration Management Group: Schema, newsletters, publications, extent of global adoption, presentations

- Business Payments Coalition (US)

- Common Global Implementation - Corporate to bank schema mapped to US and global payment systems, documentation:

- SWIFT – SWIFT standards and documentation, online tools